Overview of School Funding

Overview of School Funding

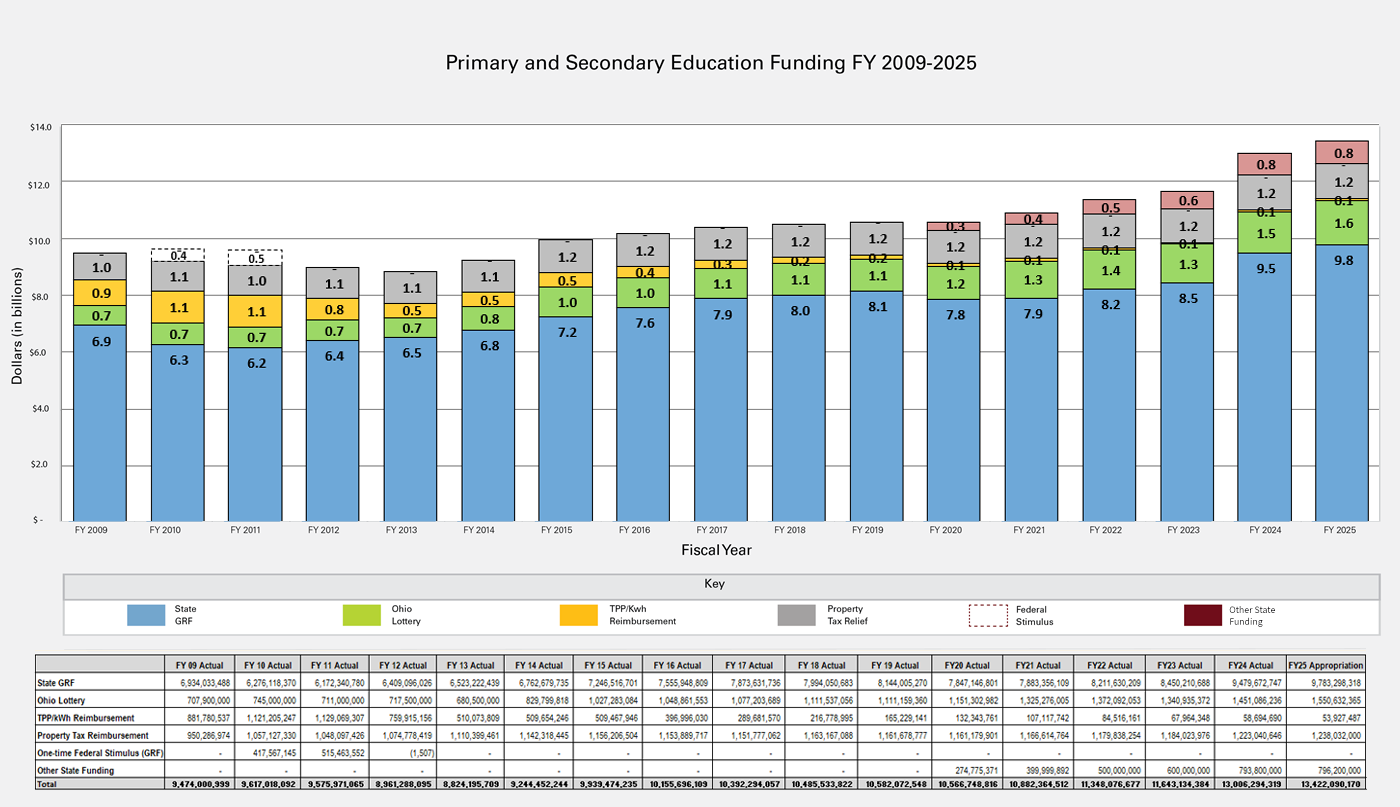

In fiscal year (FY) 2023, the state of Ohio spent more on primary and secondary education than at any other time in state history. And state education spending will continue to increase.

FY 23 State General Revenue Fund (GRF) and Lottery Profit spending for primary and secondary education totaled $9.79 billion and exceeded FY 10 spending by $2.77 billion, or 39.5 percent. Even including one-time federal stimulus dollars, Tangible Personal Property Tax (TPP) and Public Utility Deregulation Replacement (KwH) reimbursements and property tax relief, FY 23 funding exceeded that of FY 10 by $2.02 billion, or 21.1 percent.

Ohio’s biennial budget for FY 24 and FY 25 continues the record investment of state dollars in primary and secondary education. Much of this money is distributed through the continued phase-in of the foundation funding formula first implemented in FY 22, along with expanded access to school choice through universal access to the EdChoice scholarship program. State funding for primary and secondary education totaled $11.64 billion in FY 23; is estimated at $12.97 billion in FY 24, the first year of the state’s biennium budget (a $1.32 billion or 11.4 percent increase); and is estimated at $13.39 billion in FY 25, the second year of the state budget (a $425.1 million or 3.3 percent increase). This represents $3.07 billion in new state spending during the biennium.

The GRF portion of these appropriations is $10.61 billion in FY 24 and $10.99 billion in FY 25. This represents growth of $976.4 million, or 10.1%, in FY 24, and another $379.2 million, or 3.6%, in FY 25. Lottery appropriations exceed $1.5 billion in both fiscal years. State education spending in this biennium represents the largest commitment of state appropriations.

Click to enlarge bar graph and data image.

How School Funding is Distributed

Public school districts use a combination of state funds, local property taxes (and in some cases school district income taxes) and federal funds.

The amount of state funding a district receives is based on a school funding formula that was first implemented in FY 22. The formula:

- Funds students where they are educated rather than where they live. Generally, this eliminates the deduction and transfer of dollars from resident districts to other schools or districts for students who attend community schools, STEM schools, scholarship programs and open enrollment.

- Establishes an input-based funding model informed by professional judgment. The formula establishes a base cost methodology using student/teacher ratios, minimum staffing levels and actual costs. This results in a unique base cost per pupil for each school and district in the state.

- Acknowledges that school funding has always been a partnership between the state of Ohio and the local school district. The state formula works to equalize funding and provide additional money to schools and districts that do not have capacity and wealth to raise revenues locally. The state and local cost methodology uses both assessed property values and income to determine the state share.

- Provides supplemental money based on student need and demographics. This includes funding for students with disabilities, English learners, gifted students, economically disadvantaged students and those participating in career-technical education. Generally, these supplemental dollars are restricted to support these student subgroups.

About School Funding

The Ohio Department of Education and Workforce’s General Revenue Fund budget represents the largest component of primary and secondary education support. These dollars, along with profits from the Ohio Lottery and from sports gaming tax profits, fund Ohio’s 611 public school districts, 49 joint vocational school districts, 335 public community schools and 8 independent STEM schools. They also fund Department initiatives, including money for early childhood education, pre-school special education, assessments and the state report card.

In addition to state aid through the foundation program, school districts receive reimbursement payments for lost property tax revenue caused by:

- The phaseout of the general business tangible personal property tax (TPP);

- The reduction of property tax assessments on utility property (KwH);

- Tax relief (10%) on a portion of locally levied property taxes for residential and agricultural real property owners; and

- Tax relief (2.5%) to individual property taxpayers in Ohio.

Most Requested Reports

Last Modified: 11/9/2023 10:20:04 AM