June Newsletter

6/7/2023

ESSER II and GEER II Funds Expiring - No Carryover

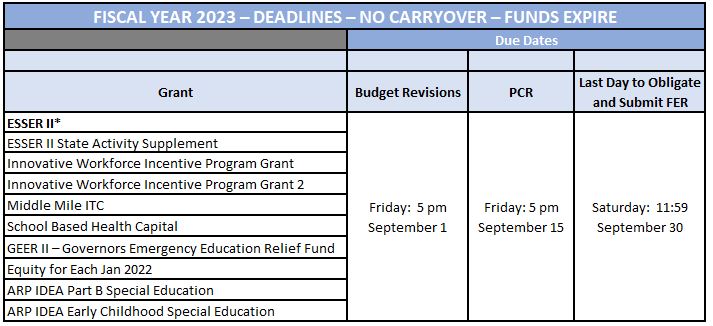

The Department is committed to supporting Local Education Agencies (LEAs) and educational entities as they close out their Fiscal Year (FY) 2023 emergency relief funds. The table below outlines key dates.

IMPORTANT:

- * If your district anticipates having unspent FY23 ESSER II funds, please review expenditures charged to the ARP ESSER grant and consider moving/journaling allowable costs to ESSER II. In doing so, if a budget revision is required, you have until 5 p.m. September 1, 2023 to submit a revision. (Remember, the substantially approved date for both grants is March 13, 2020). Note: The Department recommends journaling expenses prior to June 30 when books are closed for the year.

- Typically, expenditures reported on an FER must be obligated between July 1 – June 30 and liquidated by September 30 of each fiscal year. However, for the above FY23 grants, expenditures that were obligated and liquidated July 1, 2022 - September 30, 2023, can be reported on the FY23 FER. Be sure to run the financial report using this timeframe to ensure all expenditures are captured and reported on the FER.

- There may be instances in which obligations have been made; but goods/services will not be received by September 30. In this case, it may be necessary to close the ESSER II purchase order and reopen using another funding source (i.e. ARP ESSER). Contact your program office consultant with questions.

- Federal Guidance (2 CFR §200) does not permit the awarding agency to fund an award beyond the approved budget period. The deadlines for obligations are based on statutory and regulatory requirements and cannot be extended. All expenditures charged to the grant must be obligated and paid within the timeframe outlined above.

Budget Revisions and End-of-year Expenses

As the end of the fiscal year approaches, it’s important to remember a fiscal year’s funds should be obligated only to meet a bona fide need arising in the fiscal year for which the award was made. Therefore, ordering and receiving goods and services at the end of the grant period may result in an expense being unallowable if it is determined the expense belongs in the next fiscal year. The Department recommends incurring obligations in sufficient time for goods and services to be received and provide a benefit during the award’s period of performance. Review “

Factors Affecting Allowability of Costs” for additional information.

The last day to submit budget revisions normally is June 30. However, some grants have an earlier or later cut off so be sure to check with the program office and submit any necessary revisions by the applicable date.

Summer Stretch Pay

When the school year ends, many staff members do not report to work but still receive pay during the summer months. All salaries charged to FY23 grants must be for staff that were physically at work on or after July 1, 2022 or the grants substantially approved date, whichever occurs later. Salaries paid July - September 2023 to teachers who are not physically at work (off during summer break) but being paid over 12 months should be charged to your FY23 grant and reported on the FY23 FER.

When staff returns to work for the 2023-2024 school year, you should begin charging salaries to the FY24 grant.

Review

this document for assistance with charging salaries correctly. If any salaries are unallowable, please remove them from the grant and report the updated salary amount when submitting your next PCR or the FER.

Items ordered in FY23 but received in FY24

(Consolidated Grants)

The Department recognizes that supply chain issues are still a part of our business. Supplies and materials should benefit the year in which they are paid and should be used in the year funds were drawn (

Factors Affecting Allowability of Costs).

We are providing steps for a grantee to take if supplies and/or materials were ordered in one fiscal year but will receive the items after the FER is due on September 30, 2023. Please take the following steps if necessary.

- The district enters a History Log (HL) note when completing the FER requesting a substantially approved date (SAD) in FY24 for the amount to cover the cost of the supplies/materials in the new fiscal year. The HL note should contain an explanation that the supplies were ordered in the previous year (FY23) but have not arrived and will be used to benefit the program when they do arrive in the current year (FY24). The HL note should describe the supplies, amount needed for the SAD, what the supplies are for and when they were ordered. Be certain to send a copy of the HL note to the ODE Application Contact.

- The Department’s program office consultant will review and approve the SAD in the new year (FY24) for the amount and for the supplies requested in the HL note with SAD, amount and supplies stated in it.

- The district will close the old purchase order in the previous year (FY23) to be able to complete the FER.

- The district will create a new PO in the new year (FY24) dated July 1st and attach the old PO with an explanation for its records.

Two items to note in this scenario.

- This only pertains to supplies and materials. Work completed should be paid for in the year the work was provided. If an invoice comes in after the FER has been completed for work provided in the previous year, the district will need to request the FER be reopened and adjust the report accordingly.

- Supplies and materials ordered late spring or early and not needed for the remainder of the year, should be ordered under the new fiscal year when the program will benefit from the expenditure.

For grants other than those in the consolidated application, please reach out to the grants program contact at the Department for acceptance of the above steps.

IDEA Part B Early Childhood Special Education Funds

Unclaimed Funds Expiring Soon

School districts, community schools and county boards of developmental disabilities may have funds that have been unclaimed and are still available to support programming, activities or supplemental services for students with disabilities ages three through five that are in preschool and/or kindergarten. However, access to these funds may be limited. Fiscal Year 2022 IDEA Part B Early Childhood Special Education

Incoming Carryover funds must be obligated and liquidated by September 30, 2023. Funds must then be requested via PCR by December 30, 2023 in the FY23 or FY24 application To determine if you have FY22 unspent funds, review the FY22 FER and ensure funds equal to or greater than the “amount to carryover” has been obligated, liquidated and requested via a PCR by the dates indicated above.

IDEA Part B Early Childhood Special Education Funds

In Fiscal Year 2022, educational entities that reported serving children with disabilities ages three through five or reported that they could serve these students in the future received IDEA Part B Early Childhood Special Education funds in the Department’s grant system, the CCIP. This includes entities that could serve five-year olds in kindergarten, regardless of whether or not they are currently serving children with disabilities.

These funds can be used to serve children with disabilities ages three through five, even those students age five who are in kindergarten, or those students who may be entering kindergarten in school year 2023-24.

Using IDEA Part B Early Childhood Special Education Funds

IDEA Part B Early Childhood Special Education Funds may be spent on

any allowable use under IDEA Part B, as long as the funding is used to support children with disabilities ages three through five. These allowable use can be braided with districts efforts under the coordinating strategies of

Future Forward Ohio and in meeting the requirements for Step Up To Quality (SUTQ) and Preschool Licensing.

Examples include:

Overcoming Obstacles

- Mental Health Services and Support

- Playground and Building Accessibility

- Assistive Technology & Equipment

- Sensory Supplies & Materials

Accelerating Learning

- Summer Programs to Support Transitions from Part C to Part B and Preschool to Kindergarten

- Social Emotional Learning and Development Curriculum Materials

- Extended School Year Services

Preparing Students for Future Success

- Professional Development for Special Education and Related Services Personnel

- Family and Community Engagement Events for Families of Children with Disabilities

- Kindergarten Readiness Events for Families of Children with Disabilities

Step Up to Quality and Preschool Licensing

- Professional Development for Special Education and Related Services Personnel

- Supporting Families of Children with Disabilities with Transitioning to Kindergarten

Contact

The treasurer or fiscal representative for the district, school or organization can identify any unclaimed funds that may be available for early childhood special education programs. Contact

Jody.Beall@education.ohio.gov in the Office of Early Learning and School Readiness with additional questions.